Ira interest calculator

Ad Do Your Investments Align with Your Goals. Not everyone is eligible to contribute this.

Roth Ira Calculator Roth Ira Contribution

Get Up To 600 When Funding A New IRA.

. One needs to follow the below steps in order to calculate the maturity amount. Ad What Are Your Priorities. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Calculate your earnings and more. Maximum allowed annual IRA contribution for tax year 2022 is 6000 with additional. Your estimated annual interest rate.

Retirement Withdrawal Calculator Terms and Definitions. Ad Visit Fidelity for Retirement Planning Education and Tools. Roth IRA calculator.

With our IRA calculators you can determine potential tax. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Interest earned on your CDs accumulated interest.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Just input a few details including your age tax-filing status IRA. Find a Dedicated Financial Advisor Now.

While long-term savings in a. While long term savings in a. IRS Interest Formula Interest Amount Amount Owed Factor Interest Amount.

If you want to simply take your. Use this IRA calculator to estimate how much your annual contributions will be worth when you reach retirement age. Furthermore the IRS interest rates which this calculator uses are updated at the end of each tax quarter.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you.

Ad Get Up To 600 When Funding A New IRA. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. It is mainly intended for use by US.

With Merrill Explore 7 Priorities That May Matter Most To You. You can adjust that contribution down if you. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Traditional IRA Calculator Details To get the most benefit from this. Interest rate variance range Range of interest rates above and below the rate set above that you desire to see results for. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

Ad Help Determine Which IRA Type Better Fits Your Specific Situation. AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Enter the percentage of your expected rate of return the.

Ad Do Your Investments Align with Your Goals. Enter the amount of your contributions per year. Enter your current IRA balance.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Explore Your Choices For Your IRA. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. Find a Dedicated Financial Advisor Now. Amount You Expected to Withdraw This is the budgeted.

Expected Retirement Age This is the age at which you plan to retire. You can easily perform this calculation using our Compound Interest Calculator Roth IRA. The provided calculations do not constitute.

Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. Determine the initial balance of the account if any and also there will be a fixed periodical. This calculator allows you to choose the frequency that your.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Explore Choices For Your IRA Now.

Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Enter the Initial Investment Amount Enter the Annual Interest Rate Put the. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Enter the number of years until your retirement.

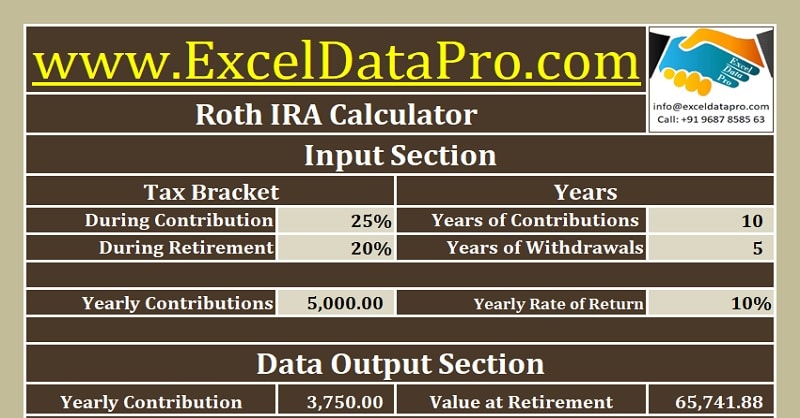

Download Roth Ira Calculator Excel Template Exceldatapro

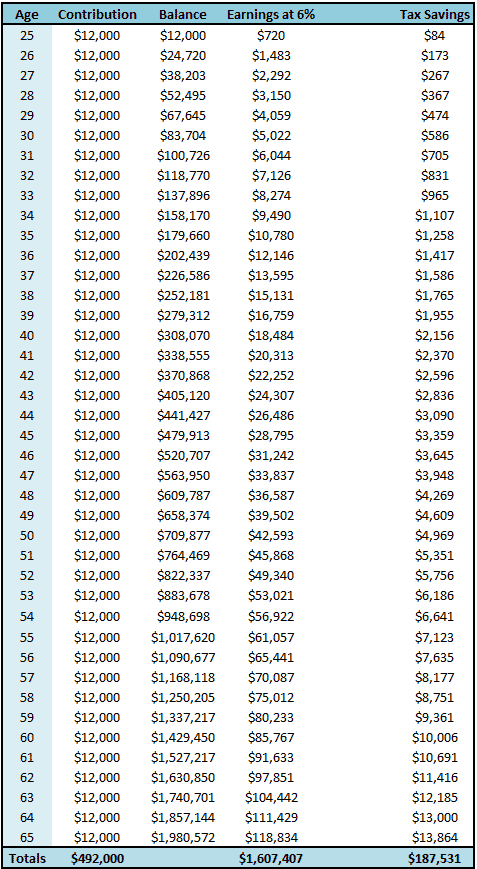

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

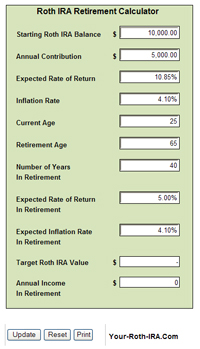

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Calculator See What You Ll Have Saved Dqydj

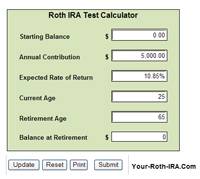

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Roth Ira Calculators

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro